Costs

Inputs that enable and facilitate live music making in Australia and their related outputs come at a cost. Labour, materials and infrastructure are either directly purchased or donated to that end. Furthermore, given the scarce resources of consumers, the diversion of money to live music implies that other opportunities to improve individual welfare are denied—another social cost that must be considered.

The total social and economic cost of live music making in Australia and its related enterprises in 2014 is estimated to be 5.0 billion dollars. This includes direct costs of 4.98 billion dollars and opportunities ‘lost’ to individuals, investors and the community of 55.8 million dollars.

Direct Costs

The direct costs cited here estimate the change in final demand attributable to live music making in Australia in 2014. These are the costs borne by individuals in the support of live music consumption and associated activities.

To avoid double counts, intermediate inputs such as the costs of production are incorporated and not counted separately. In other words, the costs of staging live music events are assumed in the final purchase price. Similarly, the equipment, labour and utility overheads of the related merchandise providers are assumed to be fully recovered by sales.

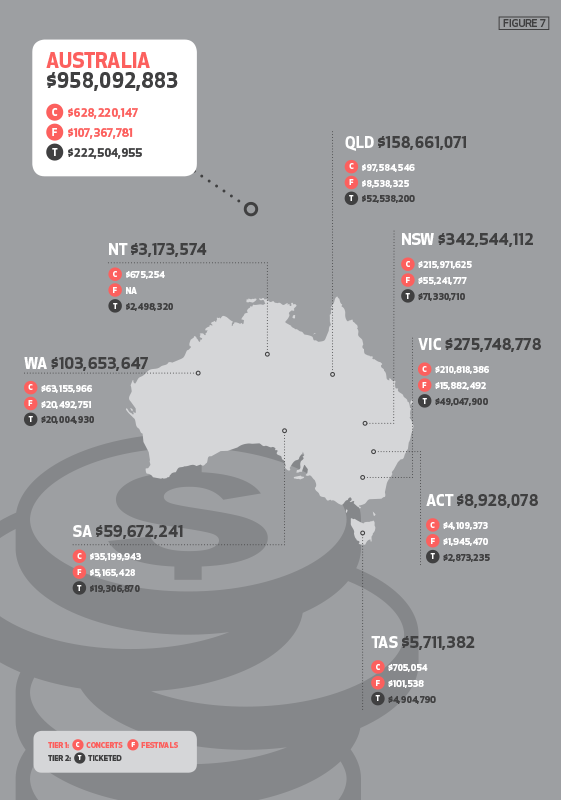

Continuing the methodology introduced in the previous section, the sum of relevant live music tickets sales is estimated in Figure 7 to be 958.1 million dollars.

Using our basic satellite account of consumption (Figure 4), which suggests that ticket sales represent 19.2 percent of total live music expenditure, we can extrapolate to estimate that in 2014 individuals directly spent 5.0 billion dollars on live music in Australia.

It should be noted that these costs are significantly broader in their coverage and greater than previous estimates of the transaction costs attributed to live music making in Australia. These departures are reasonably explained by the differences in methodology.

Importantly, our method implicitly accommodates all forms of live music making—and not just formal, venue-based production—by assuming that consumers account for this in their relative expressions of (satellite) expenditure.

The other (hopefully obvious) point to make is that these transactions are a cost, not a benefit. Studies that treat the volume of live music sales otherwise—as the majority of the ones we reviewed do—are particularly unlikely to influence the economic gatekeepers to policy reform.

It should finally be noted that this is not yet a complete accounting of costs. Live music making is subsidised by individuals, businesses and various levels of government through other venue revenue, volunteering, sponsorships, grants programs, free concerts et cetera. The sum of these investments is what is known in economics as the shadow price of, in this instance, live music production (McKean, 1968). This shadow price has the net effect of either enlarging producer profits or reducing the cost to consumers.

As such, it is a real stimulus to live music production in Australia and relevant to the scope of our enquiry. Unfortunately it was beyond our means in this instance to gather the necessary data, and the development of a more comprehensive live music satellite account is recommended as a direction for future research.

Opportunity Costs

An opportunity cost is the value lost (or forgone) as a result of making a decision between mutually exclusive choices. Thus, before assessing the economic benefits of live music making in Australia, it is useful to consider what we might have gained by using the allocated resources to their ‘next best’ ends. In order to resolve the opportunity cost conundrum, this study supposes that there is no live music making in Australia, and that the assets presently devoted to it are put to alternate productive ends.

In other words, an assumption is made with respect to the opportunity cost of these investments: if individual purchases were withheld because no value was placed on live music by the community, then the value of that contribution could be invested in long term capital growth—the supposed next best alternative use.

Therefore the value of the live music to its stakeholders is at least equal to the interest revenue forgone on the investment.

Live music opportunity cost = I x r

I = investment

r = rate of return on investment

The rate of return is determined from the 10 year bond rate of 3.49 per cent, as at 1 October, 2014 (RBA, 2014). An estimate of 2.8 per cent is further identified as the long-run inflation rate, based on the final year projection of the percentage change in consumer price index (ABS, 2014b).

r = i–π

r = real discount rate (or cost of investment)

i = nominal long-run interest rate (3.49 per cent)

π = long-run inflation forecast (2.3 per cent)

The long-run cost of investment thus applied is 1.12 per cent. To that end, we estimate that the gross cost of the opportunities diverted to live music making in Australia in 2014 is approximately 55.8 million dollars.