Projects

When consumers engage with live music through the purchase of a good or service they are assumed to derive some benefit from the decision. A rational economic framework imposes the assumption that decision-makers are acting to maximise utility in some fashion and do not intentionally make decisions that reduce this. Therefore, for each act of participation or consumption, there is assumed to be a gross benefit (or gross consumer surplus) attached to that action or consumption.

At the very least, the gross benefit is equal to their expenditure on the items concerned. The revealed preference framework can therefore be applied to identify the minimum benefits associated with consumer expenditure. In this case, this is the 5.0 billion dollars households spend on tickets, food and beverages, and other activity motivated purchases. Yet how much would consumers be willing to pay above and beyond this amount for the full set of benefits that might accrue from their live music experience?

Determining the benefits to individuals associated with their engagement involves adding their revealed preferences to the contingent value of their of live music consumption. In this section it is found that consumers recognise a well-being surplus of 10.4 billion dollars that was directly attributable to having live music making in Australia in 2014.

The extent to which non-consumers identify a level of satisfaction with having live music making in the community is recommended as a direction for future research.

Use value

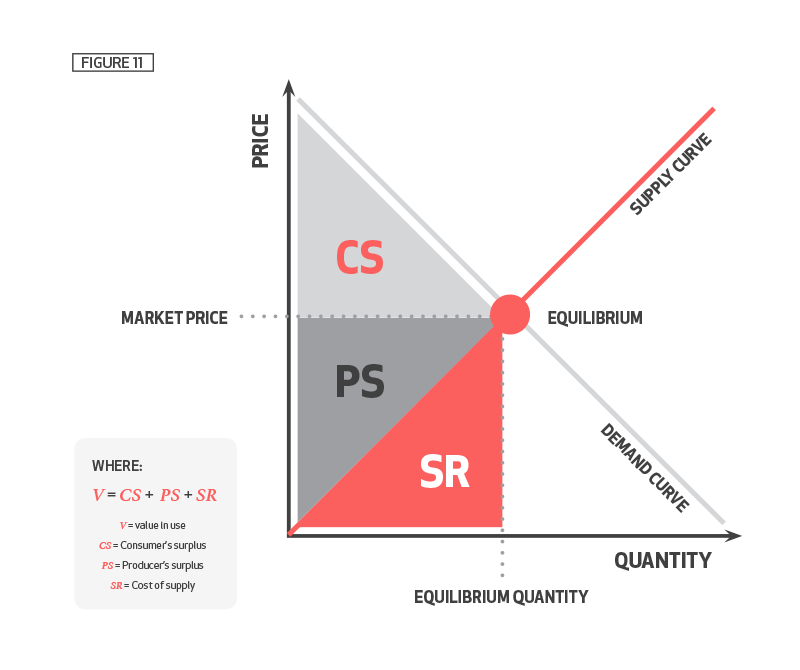

It is argued that the places where transactions occur (markets) are a social good because the exchange will only occur when both buyer and seller perceive value in their end of the deal. For the vendor, this means making a profit that exceeds their costs of production. This profit is also known as the producers’ surplus, and its value is estimated in the Commercial Benefits section of this report. For the purchaser, though, value means achieving a ‘bargain’, in that they would have been willing to pay more than they actually did for the article to satisfy their need. The welfare of both parties is thus improved, and goods and services that do not meet this twin threshold are naturally selected out of the market.

Thus the net consumer surplus is the net benefit or additional utility an individual receives in excess of the cost associated with an activity or act of consumption. In many cases, consumer surplus is an important benefit in calculating the net costs or benefits of an activity, for it allows us to arrive at a use value of a product or service. The use value (or value-in-use) is what a person would be willing to pay for their purchase / consumption of a good or service, and includes the ultimate satisfaction (or utility) they derive from it. As such, it is the sum of the purchase (or market) price and consumer surplus.

It is known from the survey of live music consumers that the market price for live music related goods and services consumed in Australia in 2014 was 5.0 billion dollars. Figure 11 shows that market price is the sum of the producer’s surplus and the cost of supply.

Survey respondents were then asked if they would be hypothetically willing to pay (WTP) to support live music; and, if so, what the value this contribution might be worth over 12 months. WTP is essentially a quantification of an individual’s satisfaction with an entity, in this case live music.

However, there was evidence to suggest some respondents to the live music survey misrepresented their preferences in reporting their WTP. Of the 1488 survey respondents, 19 reported a WTP greater than their annual income; four of which reported WTP in excess of 1010 dollars. Without controlling for misrepresented preferences analysis, results will overestimate the real WTP of consumers of live music.

To control for respondents attempting to influence analysis results, as well as the potential bias of our sample, WTP was capped at 10 per cent of an individual’s reported annual income. Although WTP should not be confused with an individual’s capacity to pay (as it is a measure of gross satisfaction), this allowed for WTP to vary within cohorts while removing the influence of misrepresented preferences. Capping WTP in this way affected 120 responses, or 8.1 per cent of the sample.

This methodology resulted in a conservative estimate of average user WTP at 938.07 dollars, or approximately 18 dollars per week, with a standard error of 52.14 dollars and a 95 per cent probability that the true average WTP lies in the interval 763.27 dollars to 1,112.87 dollars. Among the 30.3 percent of the population aged 15 years and over who attended a live music event in 2014 (ABS, 2010a), this allows for a gross national consumer surplus of 5.4 billion dollars, or 108.8% of their actual expenditure (not including shadow costs).

The gross value-in-use of live music making in Australia, being the sum of market price and consumer surplus, is therefore estimated to be 10.4 billion dollars.